QuickBooks

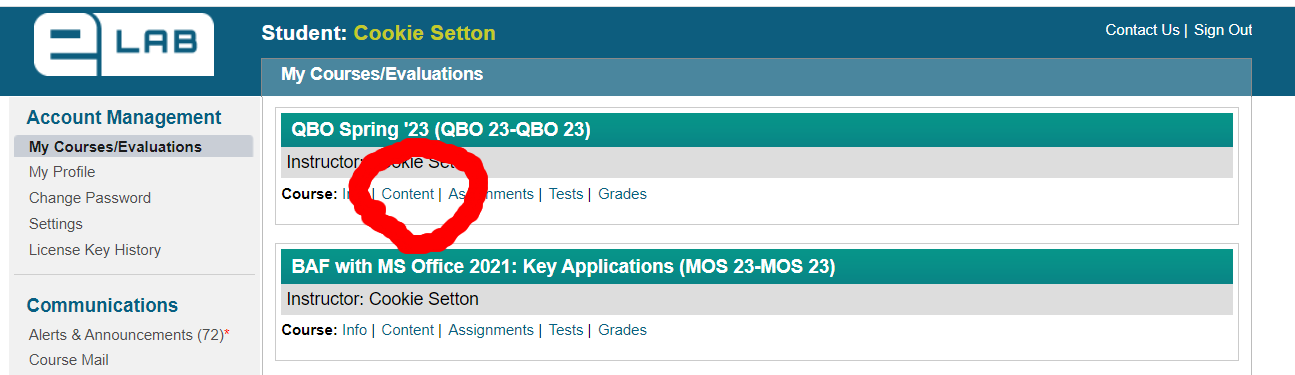

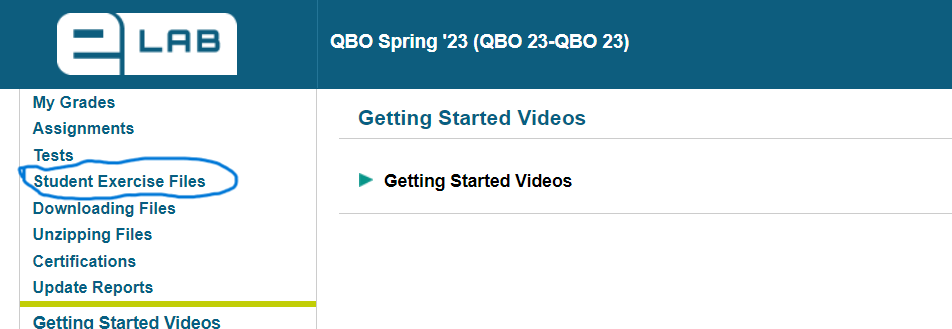

Meeting ID: 867 1570 4481 Course Code: 0Xg8H672-38682 | Comprehensive QuickBooks Class - Oct 30, 2024 Mondays & Wednesdays 10-1pm QuickBooks Online  ELAB | ELAB |  Ebook | Ebook |  Book Purchase (QuickBooks Online: Comprehensive, Academic Year 2023-2024) Book Purchase (QuickBooks Online: Comprehensive, Academic Year 2023-2024) TESTDRIVE | TESTDRIVE |  GETTING STARTED GETTING STARTED  For Puppy Luv sign in - use a different browser or profile from the one you use for Test Drive For Puppy Luv sign in - use a different browser or profile from the one you use for Test Drive-------  Notes to sign into EBOOK Notes to sign into EBOOK------------------------------  GAAP Quiz GAAP Quiz |

Recordings

1. CHAPTER 1 - Getting Started with QuickBooks Online  Oct 29, 2024

Oct 29, 2024

2. CHAPTER 2 - Setting Up a New Company File Class recording  Oct 31, 2024

Oct 31, 2024

Puppy Luv set up, Additional recording for  Puppy Luv setup

Puppy Luv setup

Homework: Chapter 2 - self assessment & Make sure you can log into Puppy Luv

3. CHAPTER 2  Nov 7, 2024

Nov 7, 2024

Homework: complete up to pages 40, prepare Excel files

4. CHAPTER 3 - Working with Customers Nov 12, 2024

Nov 12, 2024

Homework: complete to page 78 upload Chapter 3 assignments onto Elab

complete tests for chapters 1,2, 3

Complete the chapter - Puppy luv and upload the HW

6. chapter 5 Craigs  Nov 19, 2024

Nov 19, 2024

Complete tackle the tasks

---------------------------------------------------------------------------------------------------------------------------------

Nov 21, 2024

Nov 21, 2024

Dec 3, 20244

Dec 3, 20244Homework: complete page 133, upload chapter 6 QG's

9. CHAPTER 7 - Managing Inventory  Dec 5, 2024

Dec 5, 2024

Complete chapter 6 completely

CHAPTER 8 - Working with Balance Sheet Accounts and Budgets Dec 10, 2024

Dec 10, 2024

10. CHAPTER 9 Customizing, Fine-Tuning, and Extending Capabilities  Dec 12, 2024

Dec 12, 2024

CHAPTER 10 Staying on Track: The Accounting Cycle, Classes, and Locations